If you’ve seen our guide on Supplier Evaluation, you’ll know that there are several models which can be used to help you construct your supplier appraisal process.

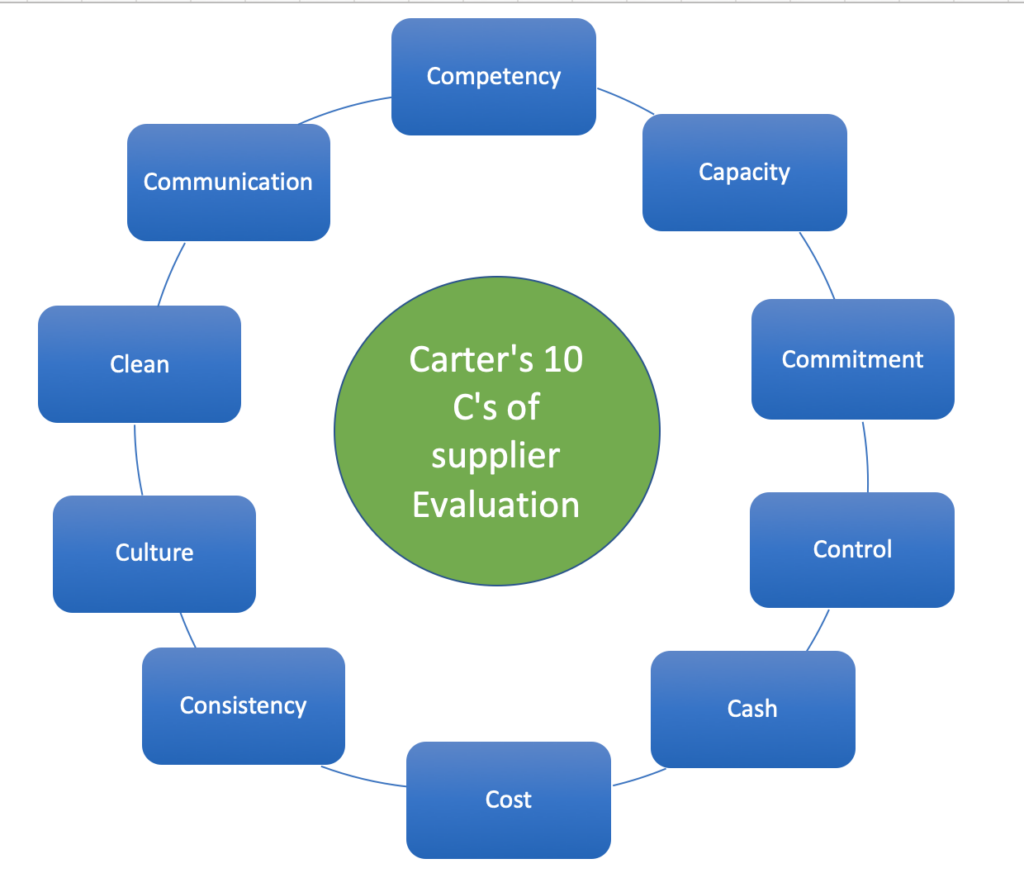

Carters 10C evaluation model offers a framework of 10 criteria that can be used to assemble appropriate screening questions to evaluate suppliers and their ability to perform.

Not only does Carters 10C shine a light on some of the criteria that you should consider, but it also highlights the importance of obtaining credible data/information about your supplier and the challenges you might face in assessing it.

So in this article, we’ll be looking at Carters 10C Evaluation model; we’ll be covering:

- What is Carter’s 10C Evaluation Model?

- What are the 10c’s?

- Why does an organization need to evaluate its suppliers?

- Who is Ray Carter

- What is the history of the model

- What are the benefits of the model

- What are the issues with the model

What is Carter’s 10C Evaluation Model?

Carter’s 10C Evaluation Model utilizes ten criteria or topics that, when used together, help:

- Guide an organization select appropriate supplier(s)

- Communicate data or artifacts that may be required to support the supplier during selection

- Remove subjectivity in the selection process

- Reduce Risk

Organizations that are looking to utilize the model can use standard rating/scoring systems that incorporate each of the 10C’s. Like most assessment tools, the results focus on:

- Capabilities – can they perform the function?

- Strengths – aspects that a supplier does well

- Weaknesses – areas that a supplier is weak in.

Carters 10C model is an important consideration during the supplier selection process underpinned by its use as part of the CIPS Procurement Certification.

What are Carter’s 10c’s?

The ten criteria to be assessed under Carter’s model can be seen in the image below:

They are:,

- Competency.

- Capacity.

- Commitment.

- Control.

- Cash.

- Cost.

- Consistency.

- Culture.

- Clean.

- Communication.

Why does an organization need to evaluate its suppliers?

As individuals, every day, we make decisions about where we buy things from. Our experiences often drive our choices. For example, can we buy it cheaper at another store? What’s the customer experience like? What happens if things go wrong? Are our issues dealt with quickly?

A business is no different.

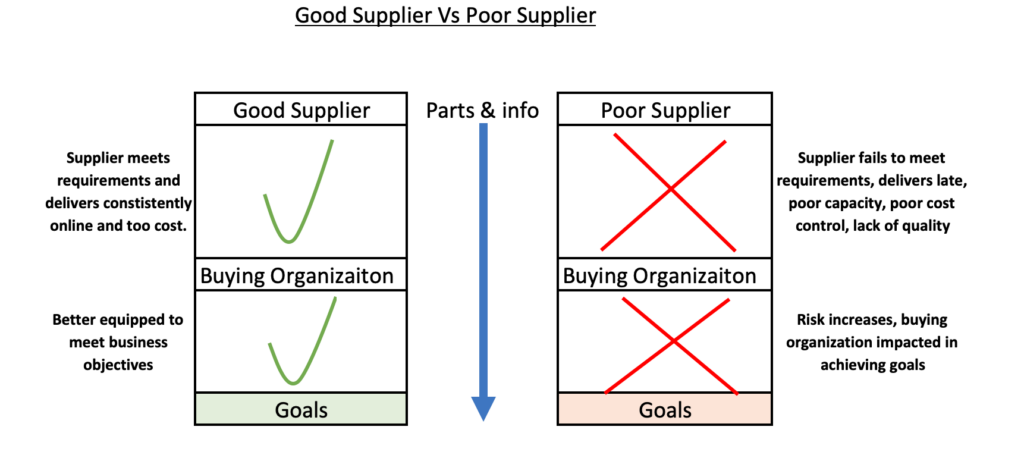

A business’s supply chain is a critical element of its ability to meet its goals.

If it has suppliers that provide poor materials, deliver late, have volatile pricing, its ability to meet its goals will be affected.

This is why it’s essential to undertake a pre-contract assessment of suppliers to ensure their suitability for use. This needs to take place ahead of any supplier being added to an ASL (Approved Supplier List).

Supplier Evaluation:

- Helps form the basis of a robust Procurement Management policy.

- Focuses on criteria of key importance to business

- Helps to improve supply chain

- Provides a standard in which to evaluate all businesses (big/small)

Cater’s 10C model uses the characteristics examined (10 C’s) and aims to provide a broad comprehension of effectiveness and ability to deliver.

What are the 10C’s of Carter’s Evaluation Model?

Before we delve into the ten criteria, it’s important to remember that Carter intended these to be used as a framework for evaluation. On their own, each of the criteria is important, but when used together, they have their maximum impact.

Below, we’ll look in detail at each of Carter’s 10C’s and examine how you can apply them to your Supplier Evaluation process.

Remember, no priority is implied; businesses looking to apply the model must give consideration to how they can utilize the criteria to meet the requirements of their own business and its needs.

1/ Competency

Competency is defined as having the skills or capability to enable you to do something successfully.

In terms of a supplier, there may be a variety of competencies that need to be assessed; such as:

- Planning

- Logistics

- Supply-Chain

- Manufacturing capabilities

- Organization

Where there are critical competency requirements, it will be important to gather evidence, perhaps in the form of references from other customers, in order to highlight areas of risk.

Assessing competencies requires careful consideration, namely:

- What competencies does your organization require its supplier to demonstrate (this may stretch beyond the simple supply of parts)

- How will these competencies be assessed?

- How will you ensure that your evaluation method provides an accurate picture?

2. Capacity

Capacity is one of those tricky ones. Many organizations can find themselves swayed by an organization with fantastic capabilities (world-class processes, equipment, people, etc.) but then fail to ensure they have sufficient capacity to supply the goods/services required, or importantly to cater for any growth or surge in need.

Capacity could be

- People

- Raw material

- Machinery

- 3rd Party Suppliers

- Logistics

- etc

The intended supplier needs to demonstrate sufficient capacity to deliver your order book and suitable processes that provide capacity management. For example:

- Do they have peak times?

- Can they offer surge capacity?

- What happens if another customer requires a large volume of capacity?

- How then do they manage their other customers (which could be you!).

- Does the supplier have the means to adequately supply what you need while also servicing other customers?

One way of assessing capacity is to have a deep understanding of what resources are required to make the goods/services you’ll be buying.

3/ Commitment.

Your prospective supplier needs to demonstrate that they have a commitment to you as a potential customer and not just at the start of the relationship (where you want to part with your beloved purchase order!).

Examine how you will sustain your relationship; why does the supplier want to do business with you? What investment are they making? How cognisant of your goals are they, and what are they prepared to do to support you?

4. Control

In this respect, control relates to their ability to control their own internal drivers to achieve your order.

For example, how will they sustain Quality? Whilst it’s straightforward to review certification like ISO9001, utilizing it is another thing altogether, and understanding how the supplier will deliver quality is key to understanding their ability to exert control over their processes.

One aspect to thoroughly investigate is where parts or information cross boundaries (i.e., from your supplier to one of their suppliers). How is this controlled? A supplier’s supply-chain management can be life or death in terms of their ability to meet Cost, Quality, and Delivery drivers.

5/ Cash

One of the more obvious assessments that should be undertaken is a review of the supplier’s financial situation.

Clearly, they should be in a good financial situation, but how should we assess that?

For some ideas, Industrystar.com has a great article on ten different assessment methods to tease out financial risk.

As the article points out, procurement specialists are not necessarily aware of how to use company financial data, which can make the task complex.

For many, this will mean reaching out to their finance department for support in establishing risks.

But what might these risks look like? They could be:

- Lack of cash

- A poor credit history may impact the ability to buy materials

- Assets vs. liabilities

- Dependency on a small number of key customers (or one big customer).

In these situations, you need to determine what’s critical and gather data around that. For an organization with many suppliers, it may not be practical to do them all in-house, and many organizations may utilize 3rd party assessment tools like Dunn & Bradstreet.

6/ Cost

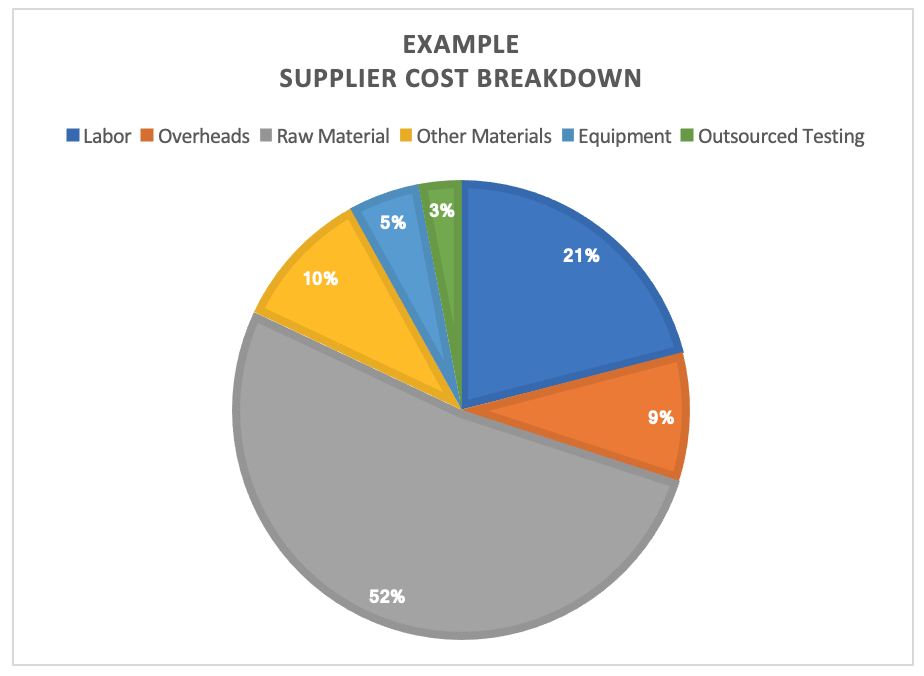

Cost is one of the more common assessments; how much does the service/product that you are looking to procure cost.

For many outside of the Supply Chain, they may consider this as the key aspect to assess; however, several other areas help establish a potential supplier’s robustness, and it’s arguable that cost is now not as important as for example, establishing risk around the supplier.

A suppliers cost is likely to be made up from a number of different areas such as the chart below. The supplier will need to demonstrate control over all of these.

While it may seem relatively simple to assess cost, there is often more to it than initially thought. Cost assessments are likely to include:

- Batch breaks

- The validity of pricing (how long a price will be maintained)

- Historical pricing with supplier

- Key cost drivers and how the supplier is able to influence them

- Discounts (for example, obtained by early payment of invoice )

7/ Consistency

So you have a supplier that has the capability, the capacity, and the right financial structure to support you. The question is will they do it repeatedly and to the desired standard.

One of the most common issues is that you have a supplier that might look great, they pass all the tests, and you add them to your approved supplier’s list.

Your first few deliveries go like a dream, but then standards and performance start to drop as they move on to support new customers.

Consistency is one of those tough nuts to crack; just how do you assess a supplier to ensure that they can perform over the longer term.

For me, this is covered by two steps

- Step 1 – Seek evidence behind their track record

- Step 2 – Review their infrastructure (processes and tools) that can drive performance

- Step 3 – Assess investment being made, examining how this will help sustain the company over the long term.

8/ Culture.

Procurement experts should also assess an organization’s culture looking for close alignment with the buying organization.

Harmonious cultures can drive closer, more collaborative relationships.

9/ Clean.

Carter argues that we should also place emphasis on a supplier’s engagement with issues such as sustainability and corporate responsibility.

As part of our evaluation process, we should assess associated credentials and evidence that demonstrate an ethical business approach.

10/ Communication.

The final C is a critical one. Communication

We should be evaluating suppliers’ methods and processes for communicating with the buying organization (and it’s own stakeholders).

We should evaluate:

- Communication methods

- Frequency of communication

- Key Points of contact

- Issue Identification & Resolution

- Escalation routes

Communication is a key facilitator that drives effectiveness and efficiency. Without it, issues can arise, and performance can be affected.

Who is Ray Carter

Ray Carter, creator of the 10C model., is Director of DPSS Consultants and author of several books on Supply Chain, including “Practical Procurement” and”Practical Contract Management.”

You can find more about Ray on the following links, http://www.raycarter.co.uk, https://www.10cmodelsupplierselection.com

History of Carter’s 10C model

Carter’s evaluation model is now over 20 years old;

- The model was first published in 1995 in the Journal of Purchasing and Supply Management

- It was originally based on only seven criteria; this was later expanded to ten.

- It is currently included in the CIPS syllabus

- The original model has been adopted & adapted

- More recent adaptations of the model focus on suppliers’ data that underpin the development of partnerships rather than just being transactional focus.

Benefits of Carters 10c evaluation model

Benefits include:

- Comprehensive framework covering critical success factors relating to supplier evaluation

- Easy to adapt

- Simple to use

- Can help reduce risk

- More robust evaluation methods identify potential partners rather than just suppliers

Issues of Carters 10c evaluation model

Issues include:

- Requires careful consideration prior to use in order to be effective

- Requires a structured approach to get the best out of it

- Gathering evidence and data could be complex

- It can take time & resources to deploy effectively

- Does not prioritize or offer weighting against criteria

- Assumes that criteria are the same across industry/geo-location

Summary

Given the critical importance most organizations have on their supply chains, it’s vitally important that a suitable evaluation method is in place.

Carters 10C’s covers most bases, looking at what’s important and why.

Similar to other evaluation models, you get out what you put in, and the model is not a silver bullet that you fire and forget; it requires careful thought ahead of roll out and support for potential suppliers during the process.

Have you utilized this approach with your supplier evaluation?

What are your thoughts on the method?

As ever, we’d love to hear from you; you can reach us at Twitter (www.twitter.com/sanbustrain) or via the comments section below.

This article is part of our Supply Chain guide.