One of the key drivers in the success of a business is the level of competitiveness within the market it operates within.

Most businesses recognize that these market conditions drive entrants into the niche and influence customer behavior. Businesses also recognize that behaviors and competition varies over time, the market conditions of today are not necessarily those of tomorrow.

Being able to map these out, using a robust and reliable tool, can inform & educate operators within the market who can utilize the results to help drive strategy.

In this post we’ll take a look at one such tool, Porters 5 Forces model. We’ll cover how to build a 5 forces template and we’ll look at this tool in detail and then examine what’s effective about it, how it can be utilized together with what issues to look out for.

About Porters 5 forces model

The Five Forces Model was originally created by Harvard Professor Michael Porter, who created the model, in 1979, for analyzing the nature of competition and influences within a particular industry.

Many organizations, to some degree, monitor their competitors and their market, but Porter argued that in many cases this was done from a state of insufficient knowledge

The model itself offers an analytical approach to understanding market conditions (and gaining knowledge) including the likelihood of potential profitability and attractiveness of a given market, this can help you tremendously in determining the viability of your business model especially if you’re looking to enter an existing market.

One of the benefits of using models such as the 5 forces model is by driving a better understanding of your business environment you are more informed to adjust your business plan & strategy, thus reducing the potential for costly mistakes.

So Let’s have a look at the 5 forces in a bit more detail.

1/ Rivalry

The intensitity of rivalry within an industry is largely driven by the other forces within the model.

Organizational rivalry can be characterized as competition for the same objective within the same industry.

If the industry sees high degrees of competitiveness then this can influence other aspects such as pricing and product innovation.

Markets that are characterized by intense rivalry also tend to be dominated by low profits and higher costs.

The impact of the other competitors within your niche, clearly has a considerable effect on your ability to succeed as a business.

Rivalry has a number of variables within the market, these includes

- Size of companies (this means they may be able to exert influence i.e. control price)

- Quantity of competitors

- Products and differentiation between yours and the other players within the market.

- Structure of costs within the industry

It’s important to consider that each of these may have varying impacts, and the impact of these variables differ between industries.

If your market is characterized by intense rivalry then you have a number of tools at your disposal to counter that, for example the obvious one is price, others include marketing & product differentiation. However all of these come with an impact and that is they are likely to erode margin. Therefore markets where rivalry is intense tend to be characterized by low margins.

2/ Supplier Power

In order to make your product you’ll most likely need to buy other products into your organization (These may be physical products or services) from suppliers within your industry. Most organizations will invest heavily in their supply chain management as this can have both a significant impact on the profitability and the competitiveness of your organization.

The effectiveness of your supply chain can have significant impact, both from a pricing perspective and availability of products. The influence of your supply chain should not be underestimated. In terms of the 5 forces model, Porter argued that supplier power was determined by a number of attributes which included:

- The Quantity of suppliers

- Commercial leverage & dominance of suppliers (and their ability to maximize their prices/profits)

- The ease that you can switch suppliers

- The uniqueness of the product/service being supplied (and therefore your ability to change suppliers easily is diminished, coupled with their ability to charge high prices (and thus reduce your profit margin).

Let’s take a look at that first point for a moment. In a market where you have a substantial volume of suppliers, then there is likely to be competition. The larger the pool of suppliers the more intense the competition, in terms of competitive offering & discounted pricing to attract customers. Where there are fewer suppliers, then they are likely to have more of an influence as they are more likely to set their own prices.

Suppliers have power when there are:

- A small quantity.

- Cost of changing suppliers is high.

- Customers have low influence.

- The product/resource they supply is scarce.

- There is commercial leverage.

3/ Buyer Power

Whilst your supply chain can exert influence in your market so can your customers.

Once again, the influence your customers can exert, particularly over price (and it’s impact on your profits, has a number of contributing factors which include:

- The number of buyers in the market (large numbers vs small)

- Who sets the pricing, is it largely driven by the company selling or are they heavily influenced by their customers

- Exclusivity/brand bias – are you customers led by brand loyalty in their vendor selection or will they buy from anyone?

- Ease of switching vendors, how easy is it for your buyers to buy from other suppliers.

4/ Threat of substitutes

Where a market has more than one supplier there are likely to be some differences between product offering (consider Windows vs Mac Book’s for example within the laptop PC market). Where there is a significant threat of subsitutes (placing the power in the hands of the buyers, then this can have influence over your pricing (and profits).

Consider:

- What is the likelihood of your customers finding an alternative product to yours?

- Is what you manufacture/produce unique (ie your customers can’t go elsewhere)

- Is it easy for them to migrate to an atlteratntive product?

- If your product can be substituted, can it be substituted for a more economical price?

- Can substitutes be easily introduced into the market.

5/ Threat of new entry

Most markets have a level of threat from new entrants – these don’t have to be local, for example consider international threats from lower cost geographical areas who maybe able to offer a more attractive price point. Another crucial factor is the ease of entry into your market. If it’s relatively easy (i.e. time and cost) you can find your self competing with other players.

A number of factors can influence this including:

- Cost of entry

- Lead time to enter market

- Customer base (size/volatitility)

- Likely profits

- Ability for new entrants to compete

- Legislation (in particular varying legislation in differing geographical areas).

- Brand loyalty – perhaps brand loyalty is strong enough to prevent new entrants profiting in the market?

If companies can enter the market relatively easily then this can weaken your position, where you have barriers to entry then perhaps your favorable position can be retained.

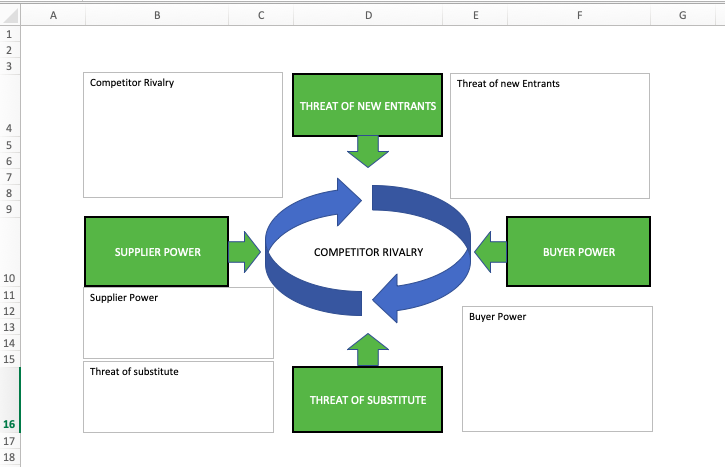

Porter’s 5 Forces Template

Building a 5 forces template isn’t too difficult. You just need to represent the 5 elements of the model and include some areas to capture the relevant data about the industry.

In our Example we’ve created a 5 Forces Template using Excel. You can see how we’ve structured it in the screen shot below. Note – this 5 forces template is designed to be printed out and then used to capture written inputs relating to the 5 forces.

As you can see from the above image we’ve created it using formatted Cells, Shapes and text boxes.

We’ve used the following steps

1/ Create the 5 elements relating to the model. For this we’ve used formatted cells (which we’ve resized) – here we’ve formatted them with a green fill & white font. We’ve then used the arrow shape to point inward to the competitor rivalry “centre”. We’ve formatted them the same colour as the boxes.

2/ We’ve inserted a circular arrow shape (copied so they look like a circle) to be on the outside of the “Competitor Rivalry”.

3/ We’ve inserted text boxes to act as areas where the user can write information about the respective 5 forces.

4/ We’ve selected the print size to print the model on a full size of A4.

Importance of Porters 5 forces model

Now we’ve covered the basics of each of the five forces we can see how it can be used to better understand a given market and the likely considerations on

- Entering an existing market

- Likely Profits within a market (High/Low)

- Likely Costs within a market (High/Low)

- The fundamental purpose of the model is to review the competition within an industry and how each represent permanent factors that drive your organizations ability to succeed.

How to use the model

So now you’ve got to grips with what the tool is and what the inputs are let’s take a look at how you can practically use the model.

As the model can help your organization in its strategic planning stages it’s important to run it regularly and then devise actions based on the results.

Firstly let us look at how the model should practically be used?

The model can be used during various phases in the business development lifecycle. The model comes into its own when used during the strategic planning phase of a business when it’s considering new markets or products.

The below table is a reasonable indicator as to what your results might show.

| Low profits | High profits |

| Strong Suppliers | Weak Suppliers |

| Strong Buyers | Weak customers |

| Low Entry barriers | Significant barriers to entry |

| Many substitutes | Few substitutes |

| High rivalry | Low levels of rivalry |

The first thing to do is to capture the current status against each of the powers & threats. This will provide the competitiveness of the current market together with relevant barriers. The results of which should indicate possible levels of costs & profits.

Next consider where the model will be over a period of time i.e. the near future. This should encapsulate changes that you see happening to the market (for example perhaps there are prospective entrants to the market that you’re aware of or perhaps new legislation is being introduced that might inapt the market.

Now, repeat the process for a long term view.

Review your results, are they similar, lower or Higher to the that of the current market or different?

Does the competitiveness (and indication of profits/costs) indicate a viable proposition?

What appropriate strategies are required to mitigate potential changes? What cost & complexity are these?

Over each time phase consider the barriers to entry & exit (High, Low, Average), this could be costs, legislation, geographical location or many others. This can help you understand both the ease of interline a market (low barriers) or the threat of new entrants (where if you’re in a market you want them to be high).

Clearly you don’t review any of these in isolation – you look at how these variables interact with one and other to get a rounded view of the competiveness of a market. Forces will vary over time. Some forces will be more substantial than others and influence will vary. Results of your analysis can be weighted in order that you can weight the results to provide a quantise score

Don’t forget that every market is different, they will have different sizes, distribution channels, growth potential, product alternatives so the 5 Forces model shouldn’t be taken in isolation.

The results of the model will ultimately provide you with information – they don’t necessarily tell you to do something. YOu’re business will need to interpret the restuls and and develop appropriate actions.

Summary

So we hope you learned from our Porters 5 forces post and that you found the section on how to create a 5 forces model template, why not give it a go with your current company/market? As ever if you’ve got feedback we’d love to hear from you in our comments section below.

This post is part of our Management & Leadership Guide.